Head and Neck Surgery

(315) Modeling the Economics of Catastrophic Income Insurance

Monday, October 2, 2023

2:45 PM - 3:45 PM East Coast USA Time

Has Audio

Ana V. Araujo

Medical Student

OHSU

Portland, Oregon, United States- RL

Ryan J. Li, MD, MBA

Associate Professor of Otolaryngology Head and Neck Surgery

OHSU

Portland, Oregon, United States

Presenting Author(s)

Senior Author(s)

Disclosure(s):

Ana V. Araujo: No relevant relationships to disclose.

Ryan J. Li, MD, MBA: No relevant relationships to disclose.

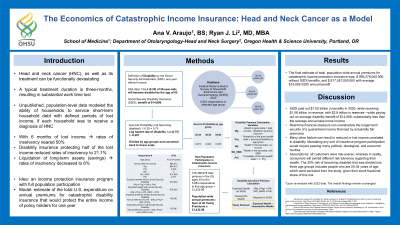

Introduction: Head and Neck Cancer (HNC) treatment can risk substantial work time loss and financial insolvency. We developed a model for a catastrophic disability/income insurance program to estimate the total U.S. expenditure on annual premiums were we to have full population participation.

Methods: This database study used income, expense, and savings data from the Federal Reserve Board Survey of Household Economics and Decisionmaking (SHED) 2019. We modeled treatment/recovery for a HNC patient that resulted in 6 consecutive months of lost income, estimating 50% of US households would be insolvent—in need of income protection. We risk-stratified respondents 35-64 years old, using Social Security Administration estimates of disability (25% of current 20-year-olds will become disabled for at least one year by age 64 years). This age group was taken as the most probable to sustain a disability insurance market. Based upon the probability of disability, we modeled each respondent’s expected wealth and the actuarially fair premium they would pay annually in a catastrophic insurance program.

Results: Converting the overall probability of disability (25%) to a logarithmic scale (Ln(0.75)=-0.287) allowed us to divide this aggregate risk across three age groups: For ages 35-44 years—a disability probability of 0.027; ages 45-54 years--0.08; ages 55-64 years--0.18. We calculated each respondent's expected wealth and insurance premiums using this age-adjusted risk of disability. Data from 9,406 SHED respondents was scaled to estimate an aggregate population-level annual premium of $709 billion.

Conclusions: This model estimated the expenditure for a catastrophic disability insurance program guaranteeing full income protection but at a cost material to many households. For comparison, Social Security Disability Insurance paid out $1.05 trillion in benefits in 2020, receiving $1.06 trillion in revenue, averaging just over $12,000 per annual claim. Highly morbid disease states such as HNC compel discussion regarding more substantial income protection programs as a need that parallels health insurance coverage.